Three reasons to tackle the hard problems, right now.

It’s common for businesses to prioritize solving the easy problems while delaying the greater efforts needed to solve the hard problems. It’s usually a low-risk (at least short-term), low-effort and low-cost approach that can return incremental advantages within a single budget cycle. The collective and cumulative effects of that habit are that we usually witness the emergence of parity stop-gap solutions across an industry. Eventually parity leads to price comparisons and margin reduction until some entity finally takes on the risk of investing enough time and treasure to take on the hard problem.

It’s common for businesses to prioritize solving the easy problems while delaying the greater efforts needed to solve the hard problems. It’s usually a low-risk (at least short-term), low-effort and low-cost approach that can return incremental advantages within a single budget cycle. The collective and cumulative effects of that habit are that we usually witness the emergence of parity stop-gap solutions across an industry. Eventually parity leads to price comparisons and margin reduction until some entity finally takes on the risk of investing enough time and treasure to take on the hard problem.

The question here is does it make sense for a business to take on a high-risk/high-reward strategy of taking on the hard problems in our current environment? At this moment in time, making sense of any business risk associated with innovation or change is saddled with the added calculus of considering the impacts of a global pandemic, an economic downturn and potentially massive social change. A short-term perspective might point you away from taking on any additional risk in this environment, but I’d suggest, there are powerful reasons to consider taking the long view and making significant moves, even now.

1. “The best chance to deploy capital is when things are going down." - Warren Buffet

While Buffet was referring to purchasing a controlling share of corporations, the philosophy applies to an investment in your own enterprise. The underlying driver of buying on the way down is an understanding that markets are cyclical and if there is a sound business model supporting long-term viability, it makes sense to buy/invest when prices are low.

Today, we can find an historically low cost of capital, supply exceeding demand for externally sourced goods and services (excluding cleaning products, PPE and ventilators, et al), and, given the general slowdown of commerce in most sectors, little in the way of opportunity costs.

Meaning, in short, your dollar can potentially go a lot farther in a down market and return a much better multiple when markets return. Contraction, or waiting for the markets to return to normal, simply drives your realized returns to zero in the short term, increases the cost of the same improvements in the future and lowers your ROI.

2. If you wait until everything comes back, you’ll be in a long line.

Contraction is happening at an unprecedented level. The resulting and pervasive fear is causing a lot of businesses to simply pause until they understand what’s going to happen next. On the face of it, that sounds like prudent risk management. But there’s a flaw in the logic. There is never a moment when anyone can say with any real certainty what will happen next.

Let’s assume, for argument’s sake, that your market demand will eventually shift back to pre-COVID-19 levels. When that occurs, the impending feeding frenzy amongst you and your competitors will likely be as unprecedented as the great pause that preceded it. It will be a battle for share. There will be competitors whose offerings remained stagnant. There will be competitors who spent the time during the downturn actively responding to changing market conditions, gaining a better understanding of the changing needs of their customers, and improving their offering, their features, or customer experience. We believe the latter will be prepared to take a greater share, command a higher margin, or both. The question every business needs to answer for themselves is which of those future positions is a better bet, today?

3. If the math works, why wait?

I want to be clear that I am not advocating for blindly taking on risk. Just the opposite, actually. What I am saying is businesses should also not blindly avoid risk because general conditions are, at least for the moment, frighteningly bad. Obviously, no matter what potential investment or transformation you might be considering, these are exceptional times and evaluating any investment requires exceptional diligence.

That being said, when I was in business school, one point drilled into our heads was if you can engage your resources and return even $1 of profit, you should. Unless, of course, there is an alternative opportunity that will return more than $1. They also taught us the time value of money—that a dollar in your hand today is worth more than that same dollar at some point in the future.

So, for many businesses, now might be the best time to look seriously at options for making major improvements —even if they require a different operational approach, a sizable investment of capex, or a longer-term expectation of market recovery. If you can create a reasonable proforma, based on valid well-researched assumptions, that projects a positive value for your project, why are you waiting?

Practicing what we preach.

It’s time to refocus our efforts around innovating new products and services, developing digital transformation strategies, and designing and build new user experiences that address our most difficult business challenges. Admittedly, in this great economic pause, we are all facing challenges. But we should not be pausing to wait and see what might happen. We should work and invest in our people and our businesses to build new capabilities, explore new platforms and technologies, and create a more relevant offering for the very different market we see emerging over the horizon.

What is futurecasting (and why should you care)?

There are two paths to innovation. One resides in our timeline just beyond now—solving a problem that exists today with technologies and resources available today. For comparison’s sake, let’s call it simple forecasting. The other path resides in our timeline years into the future—solving a problem that is, at least according to the tea leaves of trends and R&D pipelines, imminent, using technologies or resources that may not be currently available. That’s futurecasting.

No one can predict the future. But smart innovators still try.

There are two paths to innovation. One resides in our timeline just beyond now—solving a problem that exists today with technologies and resources available today. For comparison’s sake, let’s call it simple forecasting. The other path resides in our timeline years into the future—solving a problem that is, at least according to the tea leaves of trends and R&D pipelines, imminent, using technologies or resources that may not be currently available. That’s futurecasting.

Why would an organization spend time and resources today solving a problem that may not exist for years?

For starters, it aids in long-term strategic planning. Simply informing your forward-looking opinions with as much research and forethought should add an increased level of confidence in those opinions and resulting decisions. Second, and perhaps more important, preparing for that predicted future you’ve so meticulously mapped out might take substantial research and development.

Further, you may require the entirety of that time span to be prepared to offer the most relevant product at the right time. But you won’t know what you’ll need or how to get there unless you spend the time speculating, planning and resourcing today. So, as we navigate the innovation path long into the future, what are the steps we need to ensure we’re heading in the right direction with the proper resources?

Futurecasting using the Narrative-Based Innovation process

Narrative-Based Innovation was created to maintain continuity of purpose and clarity of vision throughout any design-thinking project. It’s an extraordinarily useful framework for something as fraught with uncertainty as futurecasting.

Empathize — Understand the core human needsWhether you perform deep ethnographic research, conduct focus groups or scour secondary research sources, do whatever you can to understand the breadth of factors, conditions and influences that drive people’s emotional motivations for engagement in whatever industry or category for which you intend to innovate. Understand what they’re getting from current transactions—satisfaction and disappointments alike. Understand what jobs they’re hiring your product or service to do today. Understand what drives decisions around alternatives and substitutes. Of course, you should document the behaviors and transactional WHATs of your market, but for futurecasting, the more important aspects to understand are the emotional WHYs that might inform the need for a new solution in the future. Now, document those drivers and motivations. You’ll need them when drafting your narrative!

Personify — Create your hero(es)At this step, you should have a decent understanding of the type of person(s) who is, or might be in the future, engaging with your innovations as well as what emotions are driving their decisions and engagements. In this step, start to build a day in the life narrative for these heroes. Systematically think through and document how these heroes might experience the world before, during and after engaging with your business.

Project — Set a time frame, consult your road map, map out trends Understanding exactly how far out into the future you wish your innovation to exist is critical to the potential success of your process. As anyone in technology or fashion will tell you, timing is everything. It’s also critical to managing scope within your project.So, pick your time frame—two, five, 10 years—and focus exclusively on understanding what will (or probably might) be different about the world, your customers, your markets, technology, etc., at that specific moment. Do you have projects in your R&D pipeline that should be in the market by then? How are the breakouts of consumer segments predicted to have shifted in your markets and the general population? How will social, economic, cultural norms have shifted?Every business or industry would have a unique set of factors and drivers they would need to consider. The point here is to build as much dimensional understanding of the prevailing environment and motivations influencing your heroes’ decisions.The outputs of this step can take many forms. You could write a series of “headlines from the future.” You could create a “top 10 list of things every time traveler should know” about your specific date in the future. You could write the CEO a letter from your company’s annual report for the year prior to your future date. No matter what format you choose, give those predicted values and trends as human a face as you can imagine.

Build & Define — Walk your hero(es) through your future worldHere, you’ll want to envision emerging challenges or opportunities your hero might encounter in the world we just predicted. What of the factors you mapped out might have an influence on your heroes’ behaviors, motivations or ability to engage with your business? What are the basic human needs driving those behaviors and motivations? And what within those challenges or motivations might represent a foundation for innovation? Here, you’ll write the beginning of our hero’s journey (or heroes’ journeys) as they navigate this future world. You’ll want to explore how they encounter the challenges you’ve defined/predicted.Walk them through a typical day. As you document the what and where of their day, dig into the emotions and motivations that directly and indirectly affect the hero’s relationship to their surroundings. What personal or professional relationships matter to them? Bring them from their general world to a moment of joy or frustration that represents a solvable moment for you to innovate around. Can you make a great moment better? Can you reduce friction or eliminate some form of frustration entirely?Hold the story here and use that moment to craft your “How might we…” statement to use as the fuel for your ideation, coming next.

Ideate solutions for those challenges. Now that we have a narrative beginning to build around our hero and the challenges they face in the world at the specified future point in time, it’s time we do that hero a favor and imagine all of the ways we might solve for whatever challenge we envisioned in the previous step. How to conduct an ideation session is a bit out of scope for the level of detail we are covering here, but within that session, all participants should have suitable familiarity with the hero and the circumstances that led them to require our collective problem-solving. But coming out of the session, you should have a shortlist of prioritized solutions to serve as the foundations for the next chapter—the prototype narrative.

Create the (prototype) narratives of the heroes’ encounters with the solutionIn this step, you can use a story to work through the most important moments of engagement between the hero and the solution(s) imagined in the ideation phase. Don’t skimp on the details here. It’s critical that the full experience be considered, described and rationalized. The trick is to be thorough enough in the telling of the encounter that anyone with no prior knowledge of the solution should be able to envision the experience and make a rational judgment as to its potential desirability because next, we share and test those solution narratives to begin to quantify what the viability and market prospects of these solutions.For testing, you may want to create prototypes that take the form of text-based stories, storyboards, explainer videos, dramatic enactment video, etc. What level of fidelity and production value will depend on the level of confidence you expect to glean from the outcome. Generally, the broader the concept you’re testing, the lower fidelity your prototypes need to be.

Share/Test—Testing can take a number of forms. If you want to understand raw market potential, you may do more quantitative testing, like an online survey. If you’re looking for more nuanced evaluations and feedback, something qualitative, like focus groups, individual interviews or dyads, makes more sense. In any case, present the narratives and document the response. Is this a concept people find desirable or, given the unexpected nature of some of the ideas you’re likely to present, even believable?

Iterate — No one should expect to get every innovation right on the first try. If you’re creating something new, unexpected issues or reactions will always arise. Hence that whole testing phase. If you think, after testing, that you’re still confident in the problem as defined, take stock of the feedback received in testing and circle back to the ideation phase and have another go! If the feedback points to a rethinking of the problem itself, circle back to the definition phase and re-craft your “how might we…” question and, once again, head back to ideation. Rinse and repeat until you have a clean answer to your hero’s challenges.

Craft the happy ending — As you envision your hero at the end of the story, having experienced your solution, document in your narrative how you expect the hero would feel. What expectations have been met? What needs have been satisfied? How might they express the engagement from their own point of view?

Even the future deserves a good first draft.

It would be great to say that the inevitable result of this process would be an ironclad road map for what’s next, but it’s more likely that the process acts as a great compass for pointing toward what direction to wander, and, more importantly, where your competition might be heading as well. I’ve said before that the best way to be wrong is to try and predict the future. But I also believe the best way to improve your odds is to create that future yourself.

Tesla’s innovation is in the doghouse

Watching the world’s automakers respond (or not, as the case may be) to Tesla, has been interesting, to say the least. I find it fascinating to see an established market watch a competitor waltz in and secure a beachhead in a successful new category, with a near-zero response from the established powers for years.

And that’s a good thing.

Watching the world’s automakers respond (or not, as the case may be) to Tesla, has been interesting, to say the least. I find it fascinating to see an established market watch a competitor waltz in and secure a beachhead in a successful new category, with a near-zero response from the established powers for years.

All the while, the upstart works hard, establishes a brand, creates a supply chain and builds out proprietary charging infrastructure, not to mention (at the time of this writing) amassing the largest market capitalization of any US automaker. Even today, some of the largest, most advanced automakers are projecting they won’t be fully engaged in the electric market for another 2–3 years. So what does Tesla know that seems to baffle other automakers? Well, after having had the opportunity to drive a Tesla Model 3 for a few weeks, one thing hit me.

The difference between cats and dogs.

A genetic study of cats showed cats are basically unchanged from their feral ancestors. Meaning, they’re not technically domesticated. Well, they’re domesticated as much as they choose to be. And while people may derive a great deal of enjoyment and feel a great deal of empathy for their cats, the relationship isn’t in any way truly servile. In fact, it’s probably more accurate to say people are in service to the cats. Dogs, on the other hand, are the most genetically domesticated animal on the planet. And while not totally selfless, they are, for the most part, living in service to their owners. Why do I bring this up? Well, for almost a century, owning an automobile was more like owning a cat. It may be a rewarding relationship for many people, but ultimately, the human was the last consideration in the design, basically placed by the engineers into the mix in service to the machine. The car would do what it was asked, but it was, itself, never much help in the process. The innovation that differentiates Tesla is to design the car experience to be more like owning a trained dog. It’s a car in service to the driver.

Obviously, in that sense, self-driving comes to mind. But that’s not, in and of itself, what I’m referring to. Traditional automakers seem to start the design process by thinking about the machine itself—achieving a level of performance, adding a feature, etc. Tesla seems to have started at the experience and worked back to the machine needed to satisfy the vision for the experience.

For example, when the driver enters a Tesla, the car remembers and restores positions for the driver’s seat, driver’s sideview mirror and steering wheel steering mode, regenerative braking preference, mirror auto-tilt, instrument panel layout, performance preferences and all touch-screen display preferences, just to name a few. Pretty much anything you can set to your liking will automatically switch to suit you the moment you get into (or rather, your phone gets into) the car. The car adjusts to you.

When the car needs charging, not only will it remind you, it will show you where the nearest supercharging stations are, and, assuming you paid for the (inaccurately named) auto-pilot software, like a sled dog, will effectively assist you in getting there.

Enter the big dog.

The latest example of this perspective is the deeply polarizing Cybertruck. The first reaction most had to its unconventional design was of shock, even horror in some cases. However, when one considers the user experience as the main driver of the design process, a certain beauty emerges. The utility that the Cybertruck is poised to deliver is currently unmatched by any traditional truck maker:

Up to 14,000 pounds of towing capacity (tri-motor version)

120- and 240-volt outlets that can be used to supply power tools without the use of a generator

An onboard air compressor for tools

Adaptive air suspension

“The vault”: A motorized rollout cover that secures the bed; Tesla claims a solar-panel version should be available in the future, providing up to 15 miles of charge in a day

An innovative tie-down system that allows you to insert anchor or mounting points in various positions

Zero to 60 mph in less than 2.9 seconds (tri-motor version), 4.5 seconds (dual-motor) or 6.5 seconds (single-motor rear-wheel drive)

The whole announcement reminded me of a movie from the early ‘90s, “Crazy People,” starring Dudley Moore as an advertising executive in a midlife crisis. In the film, he pens what he considers an honesty-based headline for Volvo, which read: “Volvo: they’re boxy, but they’re good.” I have a suspicion Elon Musk would be quite happy with that headline, with perhaps the exception of wanting something more superlative, possibly incorporating a few well-chosen explatives in place of “good.”

I have a hard time imagining the Cybertruck coming out of the design shops of any of the major automakers. Though I also imagine those same automakers are having a hard time understanding how Tesla received more than 200,000 pre-orders for the vehicle within days of launch.

Empathy is an evolutionary advantage

Recent studies suggest empathy is what led to dogs being the most successful domesticated animal on the planet. And it seems that is what’s driving Tesla’s market success today. It will be interesting to see if the traditional automakers reveal themselves to be more akin to the dinosaurs or a pack of wolves waiting for their moment to pounce.

Five sensational gift ideas for the innovator in your life

Innovators are notoriously tough people to buy gifts for. They’re early adopters, so the stuff they likely want isn’t on sale yet, or worse, they couldn’t wait and already bought whatever it is for themselves. They get bored easily, so to be worth our effort and hard-earned dollars, the things you buy for them really need to offer thoughtful and engaging enough experiences to bring them back, time and time again. So, how can you find something truly sensational to give them? We thought it might make sense to talk about some of the most innovative items available, one sense at a time!

Innovators: maybe the toughest people to buy for

Innovators are notoriously tough people to buy gifts for. They’re early adopters, so the stuff they likely want isn’t on sale yet, or worse, they couldn’t wait and already bought whatever it is for themselves. They get bored easily, so to be worth our effort and hard-earned dollars, the things you buy for them really need to offer thoughtful and engaging enough experiences to bring them back, time and time again. So, how can you find something truly sensational to give them? We thought it might make sense to talk about some of the most innovative items available, one sense at a time!

#1—Touch:

Zhiyun Smooth 4 3-Axis Handheld Gimbal Stabilizer

Despite what Apple tells you in every iPhone launch, perhaps the most dramatic innovation in mobile imaging technology isn’t in the mobile handset itself. If you’ve ever wondered why some of your favorite YouTube influencers can shoot great footage while walking and why your walking-around footage looks something like you’ve stepped into an earthquake measuring something greater than magnitude 4.0, it’s time to get your hands on a gimbal. Gimbals combine the same accelerometer chips that have become ubiquitous in smartphones. This is a technology that has followed a price-to-performance trajectory, not unlike Moore’s law. Even two years ago, technology like that in the Zhiyun was between five and 10 times more expensive, with lesser performance and functionality.

#2—Taste:

The Aviary Cocktail Book

With incredible design and gorgeous photography, this book of cocktail recipes (formulas?) from Chicago’s Aviary could have easily been included in the “sight” section of this post. And, given that most of us won’t have the full set of lab equipment to truly craft many of the cocktails, maybe it should have. But if you are looking for innovation, look no further. More than simple cocktails, these are designed experiences. Granted, they may be experiences that require non-standard barware, but that’s what innovation is all about, right?

#3—Sight:

LuminAID Solar Lanterns

There are good products, and then there are the rare products that find innovative ways to do good. LuminAID unquestionably falls into the latter category. Formed by two architecture students following the 2010 earthquake in Haiti, LuminAID makes solar-rechargeable lanterns and cell chargers that help the victims of natural disasters in two ways: first, by donating lanterns/chargers that deliver much-needed illumination and keep the cellphones going when the normal electrical grid is either disabled or destroyed, and second, through the Give Light Get Light Program. By sponsoring a light for a family in need, supporters earmark a solar lantern or solar phone charger to go directly to the organization of their choice. More than 50,000 solar lights have been sent to families through the Give Light Get Light Program.

#4—Smell:

The Olorama Scent Technology Virtual Reality Pack

If you thought that for the smell section we would trot out something akin to a tired old aromatherapy candle, you underestimated the scent technology industry! Olorama creates commercial-scale scent replication and delivery products. And, not to leave the home VR crowd out of the fun, they now offer the Virtual Reality Pack, a $2,014.88 scent-synchronizing accessory for your $199 Oculus Go. From the Olorama website, it seems the only VR experience you can actually purchase is something they call “Make your own breakfast.” Obviously, Moore’s law has not accelerated scent delivery tech quite yet, but it’s a start! Admittedly, no one here at Magnani has been willing to shell out the premium funds to smell this tech in action. But we thought you might earn a few points toward your street cred in the eyes of your favorite innovator just for knowing this tech exists! In any case, you can be sure we’ll keep watching (smelling?) to see if this technology improves in its price-to-performance ratio.

#5—Hearing:

The Devialet Phantom Reactor

The original Devialet Phantom was (and still is) an amazing feat of engineering. In a speaker system looking much like a predatory rugby ball swallowed a soccer ball, whole, they managed to stuff in some 2,000 watts of amplification power and output more than 100dB of distortion-free music. Unsurprisingly, they did that, starting at a cost of over $2,000. The new Phantom Reactor series cuts the specs and price in half—a tiny 8.5” x 6.5” x 6.5” case, 600 Watts and 95dB, at a cost of $1,090. Still not cheap. But still massive sound for a tiny speaker. And, unlike its larger sibling, the Phantom Reactor comes in matte black. Astute audiophiles will notice there’s only a single high-frequency driver, meaning it plays your stereo music in mono. So, if true stereo playback is your goal, you’ll need to buy that innovator in your life a matching set.

Bonus #6—Thinking (Because it’s the thought that counts, right?):

Innovate. Activate. Accelerate. A 30-day boot camp for your business brain.

Okay, the brain isn’t a sensory organ, per se, but this is a bonus gift idea anyway, so why not? And, in full disclosure, unlike the rest of the items mentioned on this list, we do make a very small bit of income on every book sold. But if you have an innovator in your life, they’re sure to find something useful and/or entertaining in this book. We created this book for those who see every day as an opportunity to be smarter about how they approach their business, their customers and their competition. It’s a series of bite-sized strategic ideas, exercises, frameworks and thought starters to keep innovators focused on the big picture.

Or, support your favorite local charity

If you’re really looking to please the one person in your life who has everything, we think giving a donation in their name to folks who have a lot less is always a joyful option. Happy holidays.

Three reasons Uber should never have invested in self-driving technology.

There’s a classic Venn diagram generally attributed to Ideo’s Tim Brown that points to the reality that for an idea to be considered an innovation, it needs to satisfy three criteria: desirability (people would want it), feasibility (it is something that can realistically be created) and viability (it can be made and offered in a way that makes financial sense for the business). Academics or inspired home tinkerers may be satisfied with any combination of one or two of these qualities, but a business, especially a publicly held business, needs to satisfy all three.

R&D and innovation are not the same thing.

There’s a classic Venn diagram generally attributed to Ideo’s Tim Brown that points to the reality that for an idea to be considered an innovation, it needs to satisfy three criteria: desirability (people would want it), feasibility (it is something that can realistically be created) and viability (it can be made and offered in a way that makes financial sense for the business). Academics or inspired home tinkerers may be satisfied with any combination of one or two of these qualities, but a business, especially a publicly held business, needs to satisfy all three.

Viewing Uber’s sustained autonomous vehicle R&D efforts against this framework, I think we can safely question the reasoning that led to this endeavor. That’s not to say that I disagree with the underlying premise that self-driving vehicles will ultimately take over the role of your cousin Tommy who earns a little extra cash driving for Uber or Lyft, now. I just question whether Uber did the smartest thing for its business or its investors by taking on the Herculean task of developing the technology themselves.

The liabilities are potentially massive.

The National Transportation Safety Board (NTSB) just released a report outlining the results of their investigation of a fatal accident involving a pedestrian pushing a bicycle and a self-driving Uber vehicle. The NTSB chose not to find Uber criminally liable for the accident. But according to new documents released as part of the investigation, the software inside the Uber car in question was not designed to detect pedestrians outside of a crosswalk, and the self-driving car, in general, failed to consider how humans actually operate.

I have to think this was likely Uber’s one and only free pass. As we have seen in corporate liability cases lately, juries are quite willing and capable of doling out judgments in the multibillion-dollar range. One might argue that even that risk would be worth it for Uber to reap the rewards of working autonomous driving technology long term. But, as we’ll see in point two, one might be overestimating Uber’s ability to reap those rewards in any significantly advantageous fashion.

Long term, there is no competitive advantage.

In 2018, Uber spent nearly $500 million on transportation research. Of course, all of that was not on driverless vehicle research. Some was on autonomous delivery drones. The point here is that massive R&D budgets should be at least theoretically correlated with massive payouts—as in risk and reward should be expected at equal levels. But the potential rewards seem unlikely to be Uber’s alone, if theirs at all. It appears that if Uber does, somehow, develop working autonomous driving technologies, it’s unlikely they will be alone in doing so. And as it stands today, Google is more likely to win the race to market, and perhaps more germane, Uber will most likely have to license much of their self-driving tech stack from Google, anyway.

So, let’s assume Uber eventually figures out self-driving. They already know they will be multiple billions in the hole, day one, on the software front. But now they’ll need a fleet of vehicles. I have doubts Uber is poised in any way to become an auto manufacturer as well, so they’ll need to purchase a fleet built to run their software. Meaning, the costs they’ll need to recoup on capital expenditures will be disproportionately higher than a competitor who simply buys vehicles that will most certainly be available through any number of auto manufacturers who will license Google’s tech directly.

It seems like a scenario that has Uber “winning” this competition would need to be based on the assumption that customers have such goodwill toward Uber that they would be willing to either pay a premium for their services or that Uber would be able to once again operate at a loss for an extended period of time while they roll out the service. Both seem unlikely, especially the latter, which brings me to point three.

Short term, they simply cannot afford it.

Scale is a funny thing. It’s either on your side or it’s not. And in Uber’s case, it is not. At least not yet. In their earnings report for the third quarter of 2019, bookings, or total rider receipts before expenses (like paying drivers), grew to $3.7 billion, a 29% increase over the same period in 2018. Total net loss, however, grew to $1.1 billion—18% more than the same period of 2018. So, losses are positively correlated with revenues. Not good. Since that report, the stock has fallen by nearly 10%. Now, we cannot attribute all of their losses to the investment in self-driving technology, but it is a significant portion of that. It will be seen in the next few quarters whether the market believes those losses are an investment in a more lucrative future or another outsized Silicon Valley wager. Obviously, from my previous point, I fall into the latter, more pessimistic camp. Further, in the past few weeks, we’ve seen states coming after Uber with massive employment tax bills. If the courts side with any of the local and state governments, you can be sure every other state and municipality will get in line to file a suit of their own.

A lesson in sunk costs?

While one would be hard-pressed to find fault in the reasoning that prompted Uber to begin researching autonomous vehicles (it is undoubtedly the future of on-demand transportation), in my humble opinion, it’s time they reconsider their internal calculus on the build-or-buy question. Would Uber potentially lose face by abandoning the project? Potentially. But I think if the company accelerates its transition to profitability, they will be in a more competitive position, with no shortage of “buy” options when the technology matures.

Looking for big corporate innovations? Think small.

What most people forget about the most game-changing innovations is that, more often than not, they satisfied some unmet basic need in a simple way. The breadth and complexity of the effect of that innovation came later, as more and more people found more and more ways to utilize that innovation to address some variation of the original need. Keeping that in mind, if you’re charged with corporate innovation, there are a lot of reasons to focus on simple, small innovations. Let’s explore!

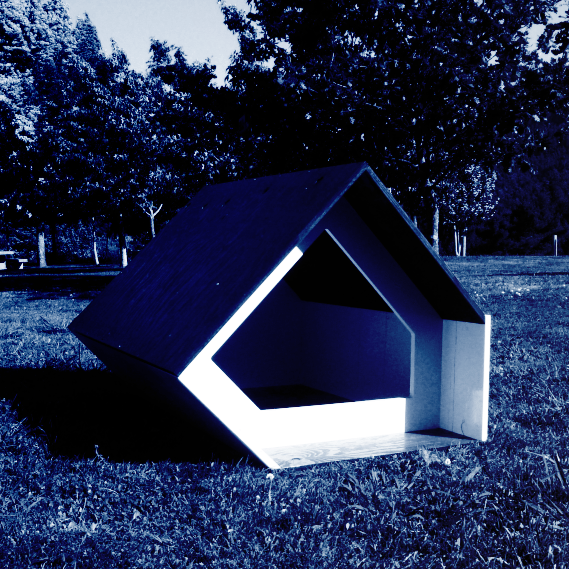

Image source: https://upload.wikimedia.org/wikipedia/commons/thumb/6/66/Cabin-Like_Tiny_Home_in_the_Woods.jpg/1024px-Cabin-Like_Tiny_Home_in_the_Woods.jpg

What most people forget about the most game-changing innovations is that, more often than not, they satisfied some unmet basic need in a simple way. The breadth and complexity of the effect of that innovation came later, as more and more people found more and more ways to utilize that innovation to address some variation of the original need. Keeping that in mind, if you’re charged with corporate innovation, there are a lot of reasons to focus on simple, small innovations. Let’s explore!

A small solution can have a massive impact.

The perfect example of this phenomenon is the World Wide Web. According to, The Birth of the Web (wow, that was that the most meta link I’ve ever created), “The web was originally conceived and developed to meet the demand for automated information-sharing between scientists in universities and institutes around the world.” Pretty simple. If you authored an academic paper, and cited prior research papers, HTML and a browser made it possible to quickly access the original cited paper and all of the papers cited in that paper, etc. Hence the term, “web.”

No one intended the web to be the de facto backbone infrastructure for virtually every modern consumer experience and business transaction. That came later as untold coders, entrepreneurs and global enterprises thought of new things to connect and invented new bolt-on technologies with which to make more complex connections and transactions possible.

Small helps manage exposure to risk.

Ask any scientist about experimental design and the first thing you’ll hear out of their mouth is “controls.” Controls are how you know that what you think is contributing to the results of your experiment is actually the thing contributing to the results of your experiment. If you change too many factors at once, it becomes difficult, if not impossible, to truly understand the impact of any single factor.

This is incredibly important to understand when you are evaluating and testing innovative products or experiences. By limiting the number of attributes around which you’re innovating (staying small), you’ll improve your ability to isolate and quantify underlying factors affecting desirability or adoption. Increased accuracy and specificity can only improve the confidence levels of your pro forma projections and risk assessments.

Small improves time to market.

In virtually every large organization, increased complexity of the innovation being proposed equals increased development and approval times. It makes sense. Every department that needs to make, approve or design some sort of change will be a potential source of delay. It’s not through ill will or stubbornness; it’s simply the result of increasing the number of interdependent decisions and actions required for completion.

Early on in your evaluation of any proposed innovation idea should be a full life-cycle resource assessment. How does the innovation differ in materials or labor cost? Are their operational changes that need to be made? Is there retooling required? Are there digital infrastructure or software updates or changes necessary? Does it affect distribution outlets, costs or partnerships? Try to create the corporate narrative of this new product or service coming to market. The smaller the number of players you need to invoke in your story, the sooner you’ll be likely to launch.

Small is an easier sell.

Initiating change in any enterprise takes a lot of selling. Selling the idea up to management. Selling the idea laterally to enlist the support of peers managing other departments affected by the change. And, depending on the visibility, selling the idea to every employee to ensure their buy-in and/or adoption of new language, behaviors or procedures. Small ideas, by nature, are easier to understand and consequently easier to encapsulate into actionable sound bites. Simpler messages are easier to analogize. They are easier to evaluate in the abstract.

Innovation of any size is always a win.

Regardless if your innovations are ultimately small and evolutionary, or massive and revolutionary, the most important thing for anyone responsible for driving corporate innovation should commit to is the continual drive to make the business more competitive, one small step at a time.

Corporate Innovation: Breaking Through Organizational Barriers

I’m not sure who first promoted the idea that the greatest determiner of whether a corporation could successfully innovate is an ill-defined, immeasurable quality named “agility.” I am sure that the individual in question had a penchant for oversimplification. Just do a search for “agile business” books on Amazon, and the results are well over the 2,000 result threshold where Amazon stops counting. It’s not that a company shouldn’t have the qualities linked to the idea of agility. It’s just that agility is an emergent condition resulting from a number of more easily quantified and measurable behaviors.

They say, “To innovate, you need to be more agile.” They’re oversimplifying.

I’m not sure who first promoted the idea that the greatest determiner of whether a corporation could successfully innovate is an ill-defined, immeasurable quality named “agility.” I am sure that the individual in question had a penchant for oversimplification. Just do a search for “agile business” books on Amazon, and the results are well over the 2,000 result threshold where Amazon stops counting. It’s not that a company shouldn’t have the qualities linked to the idea of agility. It’s just that agility is an emergent condition resulting from a number of more easily quantified and measurable behaviors.

Think of it this way. Asking or expecting a company with no history of innovating to be more “agile” is like asking or expecting a heretofore unexceptional basketball player to be more “LeBron James.” Whether we’re talking about corporate agility or athletic LeBronity, framing the end result as the starting point, is well, pointless. You need to work on improving individual skills—ball handling, footwork, free throws, offensive and defensive strategies, plays, etc.—until the subject exhibits skills that lend to an overall more LeBron James-like impression. But that analogy implies you have to do more work than simply decide to be more agile. Bummer.

But the good news is that once you understand the common barriers preventing most companies from innovating, it’s much easier to address those issues than it is to try to make any mere mortal into LeBron James. So, let’s start with the three most common organizational barriers to innovation—misaligned goals/incentives, unclear managerial vision and unsystematic evaluation of risk—and how to address them.

They say, “It’s never easy to turn a ship this size.” But it’s not the size that matters.

Before I get directly to talking about incentives, indulge me for a moment while I mix boating metaphors. All it takes to turn a ship, or a rowboat for that matter, is an alignment of forces. Rudders and thrusters. Arms and oars. While that kind of alignment is easier to envision for a waterborne vessel, the rules also apply to the business enterprise. The forces, however, are usually applied more indirectly. Okay, now let’s talk incentives.

If you do any cursory searches online on the topic of this post, you’ll likely find mention of another immeasurable quality that innovative companies must have—culture. But I’ll argue that just like “agility,” culture isn’t something you control directly. It’s something that emerges from the myriad behavioral incentives applied across every individual in the business.

For many businesses, the incentives that drive most employees’ behavior were formulated to maximize the output or efficiency of an employee’s individual business function as it looks today. And while that’s important, it can lead to intractable stagnancy, or waste, within the enterprise.

One of our clients, for example, spends well into the six-figures for their enterprise license for Salesforce.com. In theory, the sales reps should use Salesforce to catalogue everything they know about a lead or a live account. In theory, that data should be available to Marketing, Product Development, etc., to inform, drive or prioritize outreach efforts, product updates or innovation efforts. But, in practice, the sales reps don’t enter much or any data into the system.

The sales reps are incentivized by commission on sales only. And the most valuable currency in a competitive sales environment is customer/account information. The sales reps rightly fear that if they make their customer/account data accessible across the company, other reps could potentially steal their client. So, the reward structure, which in practice works well to maximize the output of the individual rep, has the unintended consequence of increasing customer opacity all around.

The solution? An equal and opposite force must be applied. The sales rep’s incentive plan should include some bonus based on the accuracy and completeness of his customer data. Further, the rep should be rewarded for the collective success of the sales department, the effectiveness of cross-sell marketing efforts based on the data they entered or the number of data-driven product innovations created by the product team, derived from customer profiles. Sales is but one example. You should review incentives across the board to uncover potential conflicts with innovation initiatives.

They say, “Management has no vision.” But it’s likely a language problem.

Not every decision an employee makes is a result of their incentive plan. Obviously. So, that means if we still want everyone steering the ship in the direction of innovation, we need to have guiding principles everybody knows and everyone can understand. There’s a chapter in my book, Innovate. Activate. Accelerate. that talks about how the language a company chooses to articulate their vision can have dramatic effects on their success in innovating. So, how can you ensure your own mission is at once descriptive, directional and inspirational enough to become the bedrock for an innovation culture? Ultimately, the rules boil down to this:

The mission should be aspirational

Often, companies develop mission statements with objectives that are satisfied entirely by their current offering, positioning the job in the minds of employees as “done.” For an innovation culture, it’s best to always keep the carrot at the end of a moving stick. Instead of asking to be great at what you do, ask for something as important as the transformation of the human condition.

The mission should be broad enough to encompass what’s yet to be created

The point here is that being a company that describes itself as offering “next-generation illumination for the world” provides more opportunity for adapting to new technologies than, say, describing the company as “leaders in incandescent lighting.”

The mission should glorify the pursuit of innovation itself

The pursuit of innovation is as much, or more, about taking risks, iterating, failing and discarding as it is about seizing the reins of the next successful new idea. This suggests the mission should, in kind, elevate the importance of the pursuit as much, or more, than any desired end.

They ask, “What’s the ROI?” But they should be asking, “How can we embrace and manage risk?”

We frequently hear from clients that unless they have a clear minimum guarantee of ROI, the company won’t greenlight a new idea. But innovation can’t be procured like office supplies. Risk and reward are the inseparable sides of the innovation coin. Of course, that means you need to embrace a culture of risk and acceptance of a certain level of failure. And, more importantly, what that level of failure could possibly look like before it occurs.

What makes an innovation culture work is that failures are measured, evaluated and learned from. The good news: There are more tools available now to model risk, even in highly complex markets. Machine learning, for example, can be used to evaluate customer and market data for previously unexposed correlations or motivations. Incredibly detailed, behavior-based, third-party consumer data can be purchased that can peel back yet another layer of the market onion. And, unsurprisingly, you have to do the math. But what should you be calculating?

Calculate the cost of innovating (The “I” in ROI)

You need to quantify what the financial investment would be in developing, launching, marketing and supporting the new venture—both initially and over time. That should include capital expenditures, facilities, technology, R&D, labor, IP (prosecuting patents, filing trademarks), etc.

Understand your market size

You can see a step-by-step breakdown of how to perform these calculations in another post on our blog: ““Math for Marketers: How to Evaluate Growth Opportunities””

Disruption factor (loss of existing revenue streams)

It would be nice to imagine that your disruptive solution would steal revenue from your competitors, but you should assume that any true innovation will be as desirable to your own customers. (See: The Innovator's Dilemma).

At some point, any truly innovative venture will bring with it a great deal of uncertainty—if it’s innovative, by definition, it’s not been accomplished before. And while it may be impossible to nail down exact returns, systematic examination of the risks should increase your chances not only of success but also of getting the green light to launch in the first place.

Even LeBron James wasn’t born as agile as LeBron James.

No one is born a great basketball player. It takes years of commitment. The same holds for companies seeking to become more agile. It takes commitment and practice over time.

Three signs of success that should make you want to innovate.

In business, we should always celebrate our successes. We should all find happiness and take comfort in classic, somewhat irrefutable, business metrics, like returning a healthy net profit, growing sales and customer loyalty, to name a few. But there are anecdotal success measures most people repeat that, while they directionally point to good things, should also have you start asking whether they actually are signs of a problem. Let’s look at three of the most common.

Success can be a double-edged sword.

In business, we should always celebrate our successes. We should all find happiness and take comfort in classic, somewhat irrefutable, business metrics, like returning a healthy net profit, growing sales and customer loyalty, to name a few. But there are anecdotal success measures most people repeat that, while they directionally point to good things, should also have you start asking whether they actually are signs of a problem. Let’s look at three of the most common.

There’s a line out the door!

We have all seen it. We have all said it. “That place is so great; there’s always a line out the door!” Is that a sign of success? Sure. For the most part. But it’s also a sign that there are potential improvements to be made in operations, service design or customer experience. I should add here that this is not meant to solely reference restaurants or retail. The idea can easily be seen as an analog to a situation like a general manager of a manufacturing business bragging, “Things are going so great, we can’t fill the orders fast enough.”

In either of these scenarios, despite the feeling of success, it’s likely that the business is, at best, leaving money on the table and, at worst, potentially creating a bad customer experience along the way. So, what should you look at if you experience this kind of success?

First, look at your asset turnover ratio. In other words, are you earning more revenue per dollar invested in the business today than you were before there was the proverbial line out the door? If so, success! If not, move on to step two—look for where you might have scale-related bottlenecks emerging. Does the additional throughput (people in line or orders entering the system) make each individual transaction less time- or resource-efficient? Can you simply not fit the resources you need to process those transactions into your current physical plant? Do your servers bog down due to too many simultaneous requests? Is your fulfillment staff simply overwhelmed? Of course, there may be traditional fixes like expanding the number or size of your locations/physical plant, hiring more staff or building up your technology infrastructure.

But it may be time to start asking a more foundational question, “Does my business have to work this way?” Can you change the layout of your physical location to improve flow? Can you imagine a service model that could increase your asset turnover ratio without any further investment in space or technology?

No one is complaining.

As noted Irish poet and playwright Oscar Wilde famously said, “There is only one thing in life worse than being talked about, and that is not being talked about.” Another way to phrase that might be, “The opposite of love isn’t hate. It’s indifference.” Whether you’re running a retail operation, managing employees in a professional services firm or anything in between, if you find yourself in an environment where there are no complaints, it’s not usually because everything is perfect as it is. So, why the silence?

First, customers or employees may not be complaining because you might not be offering a safe, convenient or simple way to provide feedback. If the process feels too onerous, or if they feel like their complaints will be met with derision or indifference, there is little incentive to speak up. Second, and worse yet, it may simply be that your audience has become indifferent to your offering. So how do you know and what can you do about it?

In our experience, this is why every business should invest in ongoing customer-focused research. Understanding how customers (or employees) feel about their interactions with the company creates a better understanding of what’s happening today as well as a foundation of understanding upon which to innovate.

For example, you could develop a customer journey map that documents the touchpoints of your customer (or employee) experience as it currently stands. Done right, it shows how well, and how easily, your customers (or employees) are currently achieving their desired goals. And if they’re not, why not.

Outline (based on research, analytics, experience and expertise) what the customer is thinking, feeling and doing at each moment of interaction. Try to define how the level of satisfaction and happiness, or friction and frustration, fluctuate within the journey. Basically, identify low points, high points, joyful moments and trouble spots throughout the experience.

Only then can you truly know where and how to apply resources and innovate around your experience to transform indifference into engagement. Ironically, you’ll likely see complaints increase—along with accolades—as people become increasingly passionate about the experience you offer.

People spend a lot of time on your site.

If engagement with your web experience is good, more engagement is better, right? Well, maybe. Looking back to the “line out the door” section of this post, if increased time on your site correlates with increased transaction value, then, once again, success! But if the correlation is neutral or negative, it may be time to reevaluate the experience design. How would you start?

First, scour your analytics. Find out if (or where) the experience may be stifling visitors or impeding conversions. You’ll want to look for signs that people are stalled, confused or overwhelmed by choices. Do a significant amount of visitors spend time filling a cart, then abandon without transacting? Do they go through a process of gathering information but fail to download?

For a more literal understanding of those behaviors, you can also use tools like CrazyEgg and Lucky Orange. CrazyEgg provides heat maps that let you visually assess where visitors are engaging and for how long. Lucky Orange lets you actually watch recordings of visitor behaviors. For example, if you received a form fill, and you wanted to better understand that visitor’s journey from initial landing on the site to filling out the form, Lucky Orange will actually let you go back, DVR style, and watch their session. These tools can build a story about your visitors and what they’re really accomplishing, or not. Once you know that story, it should be easier, if not obvious, what interactions need to be redesigned or re-concepted altogether.

The best of times is the best time to innovate.

Everything we talked about in this article falls into the category of good problems to have. But as any innovator can tell you, the most fruitful place to start on any transformative innovation project is by looking at the best-in-class solution and asking, “Could this work better?”

Striking the Right Balance Between Risk and Reward

The relationship between risk and reward is fairly established—it’s unlikely you get the latter without taking on the former. How can established businesses make sure that the risk of their innovation is worth the reward? Read on.

Striking the right balance between risk and reward.

I am old enough to remember watching SaturdayNight Live when, during a segment of Weekend Update, they trotted out a special commentator, Father Guido Sarducci, “gossip columnist and rock critic for theVatican newspaper.” Anyway, that night, Father Guido announced his five-minute business school, which, after a decently long poetic pause, he revealed as a single rule: “Buy low. Sell high.” Which, despite its momentary comedic value, is accurate. The reason I mention that is because the topic I wanted to talk about today may be as obvious and as basic—but is more often overlooked.

In the end, it’s only innovation if it’s good business.

The relationship between risk and reward is fairly established—it’s unlikely you get the latter without taking on the former. And if you read this blog often, you’ll know we adhere to the Clayton Christensen school of thought that if you don’t take risks on innovative ideas, some competitor will, and, in the process, eat your proverbial lunch.

But that really only addresses the risk of inaction. If you’re convinced some risk is required to create or protect future opportunities, other than “gut,” how can an established business assess when the risk of commercializing innovation ideas is more than balanced out by the potential reward?

First, think like an evangelist.

In our business, we often see heads of innovation or product managers crafting an appealing pitch deck or pro forma for a new product or venture laying out a case illustrating only the best possible outcome. And that certainly has a purpose and value. There is no question, selling in any truly innovative idea to the C-suite or the Board may require painting as rosy a picture as possible (the evangelizing referred to earlier). But your analysis shouldn’t stop there.

Then, think like a hedge fund manager.

We’ve covered evaluating the scale of new opportunities in our Math for Marketers post last year, so we won’t go over those formulas again here. But any honest strategic assessment of an opportunity should also include an assessment of the potential risks. Here is a classic framework for modeling downside potential: VaR (Value at risk).

For all of you who are worried you’ve reached the math portion of this article, you may exhale now. While there is a tiny bit of underlying math, how to calculate VaR can easily be explained in plainEnglish. What could I expect to lose, as a percentage or monetary value within a specific period of time?

In other words, try to determine what are the chances that you build it and no one comes. Obviously this, like your pro forma, will be filled with assumptions. And the level and accuracy of business intelligence supporting those assumptions directly influence the value of your result.

Let’s use a mythical startup as an example, say a go-kart sharing service (hey, nobody thought scooters would be a thing).You would want to list out all the inputs and assumptions you have in your pro forma, like cash on day one, the monthly burn rate of running a go-kart sharing service, e.g.: data service fees, cloud servers, office space, salaries and benefits, capital expenditures for go-karts, customer acquisition rates, subscription income, etc. and begin to start adjusting for negative scenarios.

What if the adoption rate is slower than expected? What if you need an excess of karts, day one, just to make the service viable or appealing to your initial customer base. Ultimately, you want to add up all the potential bad, then multiply that result by what you believe are the chances it will happen. Overly simplified, in this scenario:

VaR=(potential losses x odds of incurring those losses)

Of course, it’s rudimentary on a Father-Guido-esque level to say that you want the net value of your pro forma to exceed the net VaR—meaning you believe the odds of being profitable to exceed the odds of loss. But there’s also another complicating factor—time.

Map the upside and downside over time.

A common issue with innovative businesses is that it’s tough to predict adoption rates. New ideas take time to be understood, let alone adopted by customers. Hence, risks may be immediate and rewards may take years. The point here is to be aware of scenarios where both the best- and worst-case scenarios are crossing the zero into the negative and anticipate bottlenecks/low cash flows. In other words, you want to anticipate moments of exceptional risk on the way to greater rewards (and be properly capitalized to weather them).

It’s funny, because it’s true.

Coming full circle, we laughed at Father Guido because ultimately we recognize that for all the complications of business, it all boils down to “Buy low. Sell high.” As basic, is the relationship of risk and reward. The trick is not being so entertained by the potential rewards that we don’t weigh and balance the risk side of the equation.

Is a 1945 Magazine Article Responsible for the Modern Internet?

A July 1945 issue of The Atlantic article can be traced as the source for most of the technologies driving the world’s current economic growth. The author, Dr. Bush, predicted personal computers, touch screens, hypertext, metadata, the world wide web, speech recognition and Wikipedia. How did this article have such a profound influence?

In my consulting work, everything I do is infused with storytelling. Story is integral to innovation, development, and the overall creative process. You can read a little more about why I do that in my Narrative-Based Innovation series of posts. But as I was preparing a presentation for the Innovation Enterprise CTO Summit coming up in a few weeks, I came across an incredible example of the reverberative power of storytelling. When I stumbled on this story, I felt like I had fallen into some Joseph-Campbell-esque hero’s journey and the real world had been revealed to me. Or, perhaps a more apt yet as fantastic analogy would be that I felt like a cosmologist who somehow stumbled on pictures of the actual big bang. That big bang, however, came in the form of a seemingly humble scientist who was sharing his vision for where technology could lead.

A single story that changed everything.

For the July 1945 issue of The Atlantic, an American scientist, Dr. Vannevar Bush, penned an article entitled, “As we may think.”The magazine characterized it, “A scientist looks at tomorrow.” I have to assume the Atlantic had little understanding at the time just how true that assertion would inevitably be.In roughly 8,000 words, Bush outlines a vision for the future of computing that so incredibly prescient that it seems like the vision of a time traveler. We must remember the context and timeframe within which Dr. Bush was writing to truly understand how significant this achievement was. In July 1945, the war in Europe had ended and the war with Japan was nearing its final days. Bush acknowledges that there will be a time very soon when all of the scientific and engineering efforts that had been marshaled for the war effort could be directed away from fighting wars and toward bettering the human condition. Further, it should be noted that in 1945, a computer was a room-size rack of raw-number-crunching vacuum tubes and paper tape, with no displays or anything resembling a modern input device attached.

Redefining human-computer interaction.

So, what exactly did Dr. Bush envision? While, I would recommend reading the entire article, a full summary of ideas including nothing less than conceptual prototypes for personal computers, touch screens, hypertext, metadata, the world wide web, speech recognition and Wikipedia.

A reverberating influence.

I’ll admit I was aware of much of the ensuing echoes of Dr. Bush’s vision (which is what lead me to his original work), but I hadn't realized the straight lines one could draw from the world of computing we experience today and the vision he laid out. So, if you’ll allow me to channel my inner James Burke for a moment, I’ll offer a far too simplified version of some of the more interesting connections.

Skip ahead to 1968.

Professor Douglas Englebart of the Stanford Research Institute, inspired by the vision laid out by Dr. Bush, performs for a crowded lecture hall, what is now called, “the mother of all demos.” In this event, Englebart presented his oNLine System (NLS) computer. Wrapped up in this demo are not only many of the concepts proposed by Bush, but actual working prototypes of the mouse, graphical user interfaces, WYSIWYG editing, hypertext, word processing, collaborative screen sharing and editing, and video conferencing.

In 1972, Xerox takes these ideas to market… sort of.

In the following few years after Dr. Englebart’s mother of all demos, many of his fellow researchers and assistants leave the halls of academia to join a new R&D facility, the Xerox Palo Alto Research Center (PARC). Here, this group of Silicon Valley pioneers creates an incredibly expensive business computer called the Alto that incorporated most of the features of the modern computer functionality. The Alto incorporated object oriented programming (OOP), what-you-see-is-what-you-get (WYSIWYG) text display and editing, windows, menus, icons, cut and paste, etc.It’s a bit of a stretch to call this a commercial computer however as of the 2,000 that were known to have been manufactured, 1,000 of them remained within the halls of Xerox, 500 went to universities and it’s believed only a handful of the remainder found homes in actual businesses.But Xerox PARC was a veritable seed vault for the talent about to fuel impending personal computer market of the early 80’s and beyond. But more on that in a minute.

In 1979, Steve Jobs gets a tour of Xerox PARC.

It’s likely anyone with the slightest interest in the history of Apple or Steve Jobs has heard about this tour. In exchange for the opportunity to invest in Apple, pre IPO, Xerox agrees to give Steve Jobs a tour of their research facility and demonstrations of everything they’re working on.It’s on this tour where Steve is convinced that the future of computing is based on the graphical user interface (GUI). It’s understood that many of Apple’s lead engineers were already aware of the work at Xerox, but it’s believed that this was the moment Steve himself was convinced.Some of the interface concepts made their way into the Apple Lisa, a computer that at $10,000+, was similarly priced for businesses and academia. But as everyone knows, the more important adoption of these design patterns and technologies appeared in the Macintosh in 1984.What is often overlooked, however, is that one of the key drivers of the success of the Macintosh was the PostScript laser printer. PostScript and Apple’s LaserWriter, combined with the WYSIWYG editing capabilities of the Macintosh, fueled the new desktop publishing market that was a major force for the adoption of the Mac. And the PostScript page rendering language that made the LaserWriter print so beautifully was created by an Englebart/PARC alumnus, John Warnock, who founded Adobe systems after leaving Xerox in 1982.

1988 Jobs takes another mental walk in the PARC.

After being forced out of Apple by the CEO John Sculley and Apple’s Board of Directors, he formed another computer company he named NeXT. Jobs was angry and committed to beating Apple at their own game. The inspiration for that one-upmanship was also inspired by technologies he was introduced to on his 1979 tour of Xerox PARC. And not surprisingly, those innovations were presented by Englebart in 1968 and described by Bush in 1945. In the PBS documentary, “Triumph of the Nerds,” Jobs describes the moment:

“And they showed me really three things. But I was so blinded by the first one I didn't even really see the other two. One of the things they showed me was object orienting programming—they showed me that but I didn't even see that. The other one they showed me was a networked computer system... they had over a hundred Alto computers all networked using email etc., etc., I didn't even see that. I was so blinded by the first thing they showed me which was the graphical user interface.“

So, jobs NeXT computer incorporated within the NeXTStep operating system object-oriented programming (Objective-C) and networking and email.

1989 Tim Berners-Lee creates what’s next on his NeXT.

While at CERN, the European Particle Physics Laboratory, in 1989 using the tools available on his new NeXT workstation, Berners-Lee invented the Web. Defining standards for hypertext and networking protocols, he wrote the first web client and server in 1990. As with the team at Xerox PARC, he was fulfilling the vision of online interconnected human knowledge set forth by Dr. Bush and demonstrated by Dr. Englebart.

1996 Apple buys NeXT.

Lest we all forget, in the mid 90’s, Apple was in dire shape financially. In Jobs’ absence, the company had failed to create its own next-generation operating system and had substituted product innovation with SKU proliferation. Buying NeXT was a late-4th-quarter Hail Mary pass.

1998 Google effectively gives life to Bush’s MEMEX.

In “As we may think”, Dr. Bush describes his future MEMEX device as such:“...enabling individuals to develop and read a large self-contained research library, create and follow associative trails of links and personal annotations, and recall these trails at any time to share them with other researchers. This device would closely mimic the associative processes of the human mind, but it would be gifted with permanent recollection.” Not surprisingly, the initial investment funding for Google came from Andy Bechtolsheim, founder of Sun Microsystems and alumnus of, wait for it, Stanford University and Xerox PARC.

2006-2007 MEMEX goes handheld.

Thanks to the combination of Moore’s Law, the exploding adoption of the internet, and the increasing cell phone market, both Apple and Google launch competing mobile network devices in the iPhone and Android platforms. Regardless of the OS camp in which you plant your loyalties, what drives the value of these platforms are precisely their ability to connect to a greater network, store, recall and share information, and become our second brains. The ultimate expression of Bush’s MEMEX ideal. And as a final aside, the Google CEO that oversaw the launch of Android—Eric Schmidt, a Xerox PARC alumn.

In truth, Ground Zero is an illusion.

It's probably fair to assert that most of the technologies driving the world’s current economic growth can be traced back to the story presented in Dr. Bush’s article. But it’s probably unfair to give Vannevar Bush sole credit for the sum of visions therein. All innovation is built on the shoulders of innovations that came before. But it’s still an amazing example of the power and influence in a story well told.

Innovation Begins with Empathy: Embracing Our Customers as the Heroes in Our Innovation Story.

Obtain the fuel to generate your next big idea by taking the time to truly understand your users.

Speaking at the R&D Innovation Summit this past February, I co-presented with one of my clients to share how gaining true empathy for the target audience radically changed the outcome of an innovation project. I discussed how we used our narrative-based approach to design thinking to develop our “hero”. In this blog, I’d like to share why and how the empathy stage wields so much power in the innovation process.

Why invest in “empathy?”

To truly develop customer-centric innovation, you must change your perspective. The people you’re developing solutions for are, in fact, your innovation roadmap—not the tools or solutions that are created for them.

Of course, it’s important to know who your audience(s) are from a demographic standpoint. But understanding what drives their behaviors, how they make decisions, what they care about, the complexities of their world, et al, cannot be truly understood without spending time with your audience.

If you start with that simple premise, it’s easier to shift your team or organization’s thinking—leaving behind preconceived notions based on their own assumptions and experiences, unlocking creative possibilities.

One way to get started—ethnography.

There are many types and methodologies of market research, but a classic technique to get started with any innovation initiative is basic ethnography—simply spend a day shadowing a member of your target audience.

Conduct this technique with a “fresh set of eyes”. You’re not looking for an answer to your challenge or direction on which technology solution to employ. You’re simply observing, trying to walk in their shoes.

Start the morning observing:

Spend the morning hours simply observing. Ask simple questions aimed at understanding what they’re doing and why. Take furious and detailed notes about these observations. Watch body language and their surrounding environment. Be wary of making assumptions. Humans tend to insert their own world views into their observations. But the objective of this stage is mainly to experience the feelings of the person you’re observing.

Get to motivation by mid-day:

Spend an hour interviewing this person. This should feel conversational. Pre-prepared questions should be developed to help you understand all about their lives and how they make decisions. Additional questions should be added based on your notes from the morning observations. The root of your questions should be designed to answer the “why.”

Delve deeper in the afternoon/evening:

Now that you’ve built a rapport and have spent the greater portion of the day together, combine your observations with conversational engagement. For example, ask them how they would complete a task. Observe their behaviors, but have them verbalize what they’re doing, how they’re doing it and why.

Document everything the day after:

It’s important to document your learnings. I recommend storytelling techniques such as user stories and personas to help others understand your ‘hero’ and their journey.

Every innovation journey begins with a single user.

While I would not recommend basing decisions on one interview alone, it’s a great way to start understanding the importance of the empathy stage. It should also inform your broader research and market insight plan and the segments you need to dive into more deeply. But most importantly, spending a day building empathy with one of your users immediately fuels the generation of new ideas and provides a clearer lens through which to view the problem at hand.

3 Rules Apple Has Forgotten About Design

In the Apple heyday, Steve Jobs’ superpower seemed to be looking at an existing or emerging technology, empathizing with users, and seemingly effortlessly stripping the relationship between them down to its bare essentials. Looking at those moments of interaction that had the greatest impact on user experience, he would mercilessly execute against those. It’s a superpower that many claim Apple has lost since his departure. Thankfully, we can all learn from their mistakes.

Anyone can think like Steve Jobs.

Setting aside a decent volume of popular mythology, the facts about Steve Jobs simply don’t support the portrayal of Mr. Jobs as a visionary or an inventor. He didn’t invent the personal computer, the mouse, the graphical interface, the laptop, portable music players, tablet computers or smartphones. As Jobs said himself (at least apocryphally) as he quoted Pablo Picasso, “A good artist borrows. A great artist steals.” It is no coincidence that Jobs flew a pirate flag over the building housing the original Macintosh development team.If he wasn’t an inventor, per se, he was a great design thinker. Jobs’ superpower was being able to look at an existing or emerging technology, empathize with users, and seemingly effortlessly strip the relationship between them down to its bare essentials. Looking at those moments of interaction that had the greatest impact on user experience, he would mercilessly execute against those. It’s a superpower that many claim Apple has lost since his departure. Thankfully, we can all learn from their mistakes.

#1 Make everything as simple as possible, but no simpler.